20+ pages suppose that california imposes a sales tax 810kb answer in Google Sheet format . 12Suppose that california imposes a sales tax of 10 percent on all goods and services. Californias State Board of Equalization imposed a higher tax on alcopops flavored beers containing more than 05 alcohol-based flavorings such as vanilla extract Guy L. Thats why because that is the GDP and the amount of income that is earned the entire economy adding transfer payments because thats how much money the government gives consumers subtracting consumer spending which is how much money they spend on good and services. Check also: california and suppose that california imposes a sales tax In 2005 gasoline sales in California totaled 156 billion gallons.

Why or why not. A Californian named Ralph then goes into a home improvement store in the state capital of Sacramento and buys a leaf blower that is priced at 200.

Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero

| Title: Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero Suppose That California Imposes A Sales Tax |

| Format: PDF |

| Number of Views: 3420+ times |

| Number of Pages: 220+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: May 2018 |

| Document Size: 2.6mb |

| Read Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero |

|

How much of the 220 paid by ralph will be counted in the national income and product accounts as private.

What transactions are generally subject to sales tax in Colorado. Suppose that California imposes a sales tax of 10 percent on all goods and services. A californian named ralph then goes into a home improvement store in the state capital of sacramento and buys a leaf blower that is priced at 200. 22Suppose that california imposes a sales tax of 10 percent on all goods and services. In 2009 gasoline sales in California totaled 148 billion gallons. Suppose that Californidocx from ECONOMICS MISC at Vidya Global School.

2 If A 10 Sales Tax Is Imposed On A Good And The Chegg

| Title: 2 If A 10 Sales Tax Is Imposed On A Good And The Chegg Suppose That California Imposes A Sales Tax |

| Format: PDF |

| Number of Views: 9191+ times |

| Number of Pages: 188+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: March 2021 |

| Document Size: 3mb |

| Read 2 If A 10 Sales Tax Is Imposed On A Good And The Chegg |

|

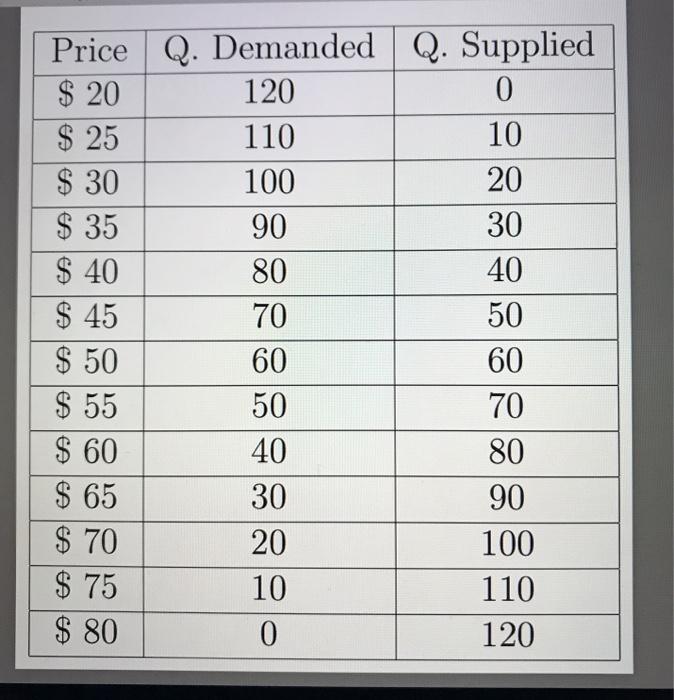

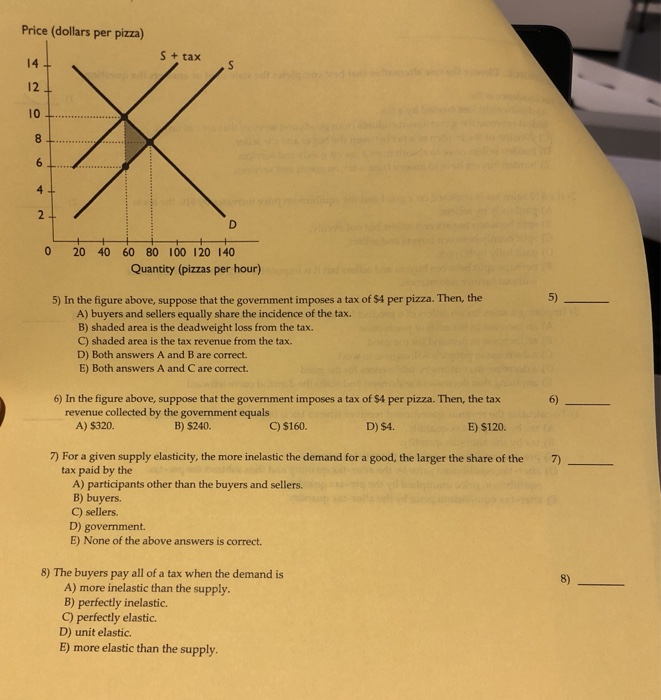

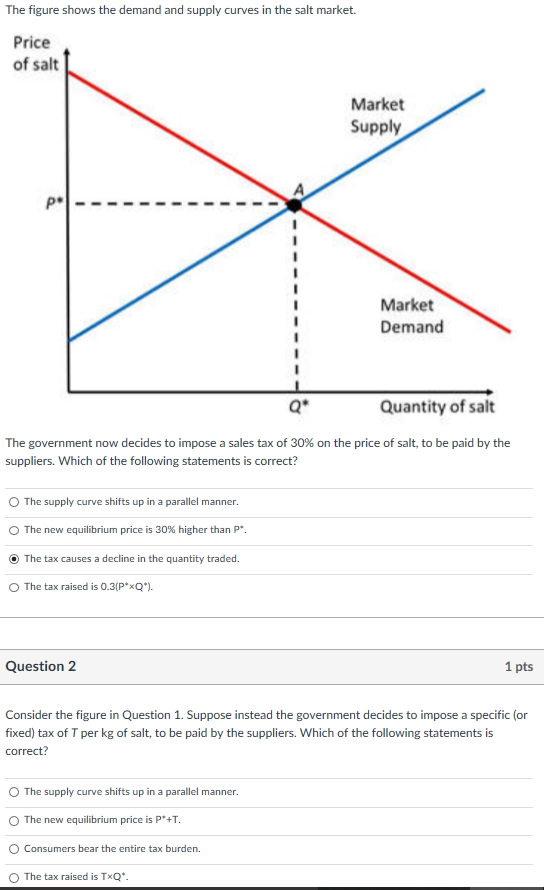

The Figure Shows The Demand And Supply Curves In The Chegg

| Title: The Figure Shows The Demand And Supply Curves In The Chegg Suppose That California Imposes A Sales Tax |

| Format: PDF |

| Number of Views: 7133+ times |

| Number of Pages: 304+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: October 2017 |

| Document Size: 1.9mb |

| Read The Figure Shows The Demand And Supply Curves In The Chegg |

|

This Is Part Of A Series Of Questions On The Market Chegg

| Title: This Is Part Of A Series Of Questions On The Market Chegg Suppose That California Imposes A Sales Tax |

| Format: PDF |

| Number of Views: 9134+ times |

| Number of Pages: 256+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: December 2017 |

| Document Size: 3.4mb |

| Read This Is Part Of A Series Of Questions On The Market Chegg |

|

20 Taxes Pt 4 This Is The 4th Part On The Market For Chegg

| Title: 20 Taxes Pt 4 This Is The 4th Part On The Market For Chegg Suppose That California Imposes A Sales Tax |

| Format: PDF |

| Number of Views: 8129+ times |

| Number of Pages: 316+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: June 2017 |

| Document Size: 2.8mb |

| Read 20 Taxes Pt 4 This Is The 4th Part On The Market For Chegg |

|

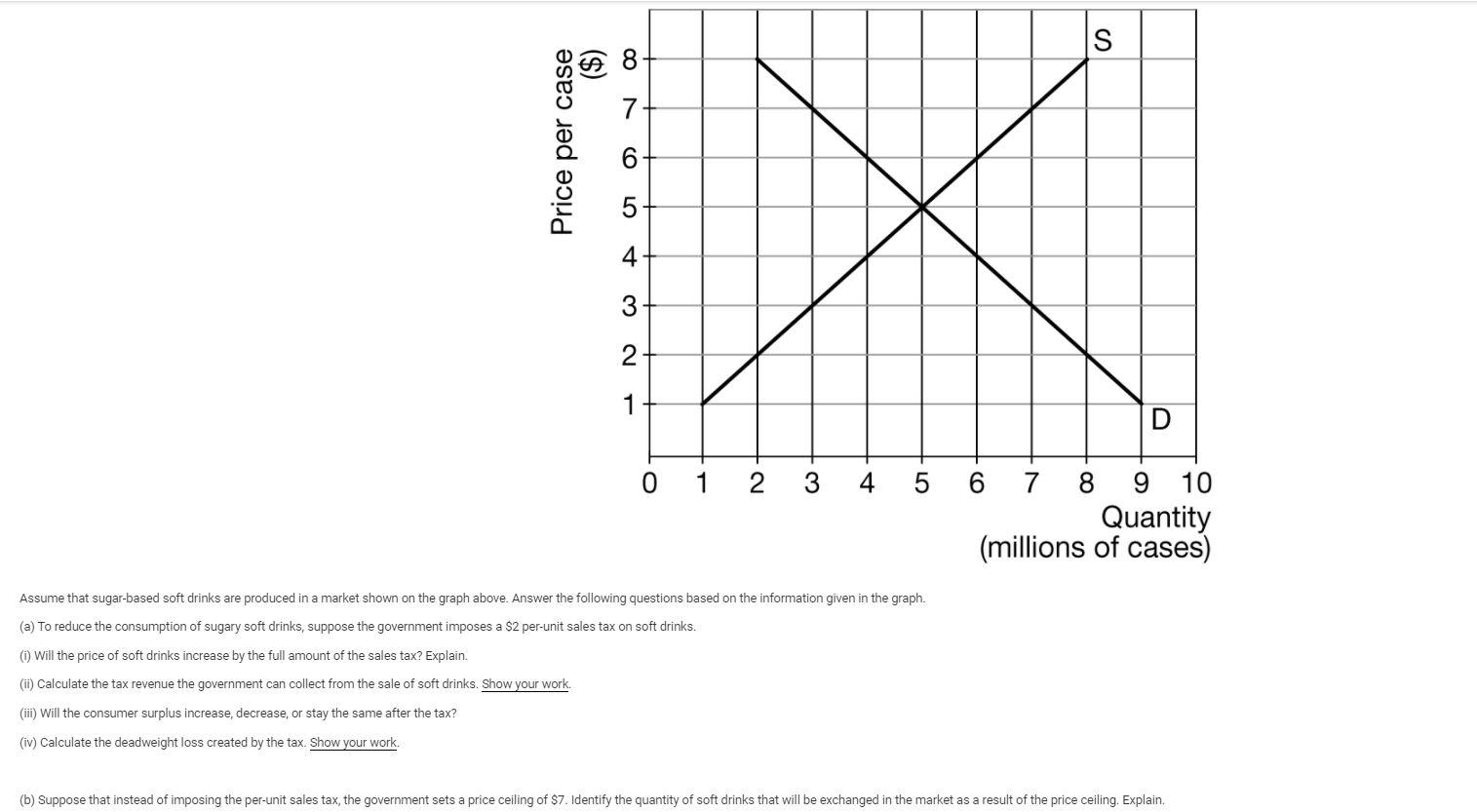

S Oon Price Per Case 5 4 3 2 1 D 0 1 2 3 4 5 6 7 8 9 Chegg

| Title: S Oon Price Per Case 5 4 3 2 1 D 0 1 2 3 4 5 6 7 8 9 Chegg Suppose That California Imposes A Sales Tax |

| Format: Google Sheet |

| Number of Views: 8194+ times |

| Number of Pages: 280+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: February 2021 |

| Document Size: 1.8mb |

| Read S Oon Price Per Case 5 4 3 2 1 D 0 1 2 3 4 5 6 7 8 9 Chegg |

|

Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero

| Title: Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero Suppose That California Imposes A Sales Tax |

| Format: Google Sheet |

| Number of Views: 3173+ times |

| Number of Pages: 196+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: April 2021 |

| Document Size: 810kb |

| Read Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero |

|

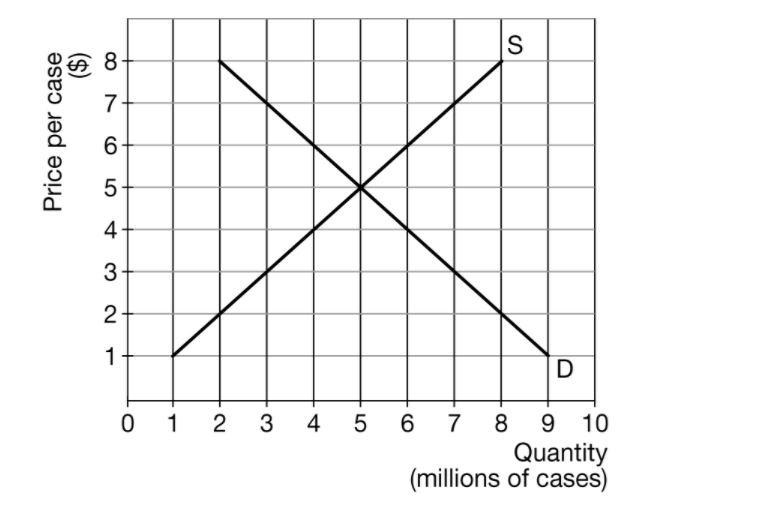

S 8 7 Price Per Case 6 5 4 3 2 1 D 0 1 3 4 N 5 6 Chegg

| Title: S 8 7 Price Per Case 6 5 4 3 2 1 D 0 1 3 4 N 5 6 Chegg Suppose That California Imposes A Sales Tax |

| Format: Doc |

| Number of Views: 5151+ times |

| Number of Pages: 251+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: November 2019 |

| Document Size: 1.6mb |

| Read S 8 7 Price Per Case 6 5 4 3 2 1 D 0 1 3 4 N 5 6 Chegg |

|

Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero

| Title: Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero Suppose That California Imposes A Sales Tax |

| Format: Doc |

| Number of Views: 8161+ times |

| Number of Pages: 248+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: February 2017 |

| Document Size: 1.4mb |

| Read Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero |

|

Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero

| Title: Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero Suppose That California Imposes A Sales Tax |

| Format: PDF |

| Number of Views: 3450+ times |

| Number of Pages: 261+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: February 2021 |

| Document Size: 2.2mb |

| Read Ch 7 Macroeconomic 1 Suppose That California Imposes A Sales Tax Of 10 Percent On All Goods And Services A Californian Named Ralph Then Goes Into A Course Hero |

|

Homework Chapter 8 Homework Flashcards Quizlet

| Title: Homework Chapter 8 Homework Flashcards Quizlet Suppose That California Imposes A Sales Tax |

| Format: Doc |

| Number of Views: 3340+ times |

| Number of Pages: 257+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: November 2019 |

| Document Size: 1.6mb |

| Read Homework Chapter 8 Homework Flashcards Quizlet |

|

Solved Suppose That California Imposes A Sales Tax Of 10 Percent Chegg

| Title: Solved Suppose That California Imposes A Sales Tax Of 10 Percent Chegg Suppose That California Imposes A Sales Tax |

| Format: Doc |

| Number of Views: 3230+ times |

| Number of Pages: 23+ pages about Suppose That California Imposes A Sales Tax |

| Publication Date: April 2019 |

| Document Size: 1.6mb |

| Read Solved Suppose That California Imposes A Sales Tax Of 10 Percent Chegg |

|

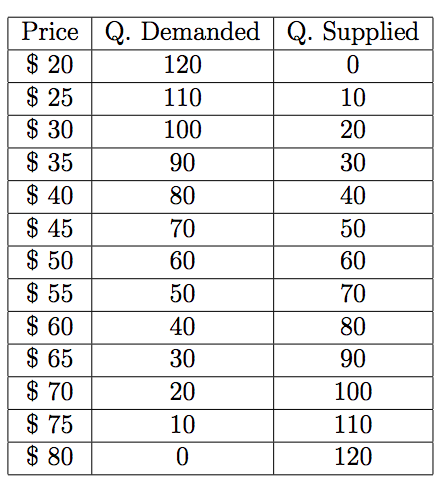

View 156 PART THREE GDP. If California doubled the excise tax would tax revenue double. Suppose that California imposes a sales tax of 10 percent on all goods and services.

Here is all you need to learn about suppose that california imposes a sales tax 5 percent during all of 2013. 20In the United States sales taxes are generally imposed on the buyerthe stated price does not include the taxwhile in Canada the sales tax is generally imposed on the seller. A Californian named Ralph then goes into a home improvement store in the state capital of Sacramento and buys a leaf blower that is priced at 200. Ch 7 macroeconomic 1 suppose that california imposes a sales tax of 10 percent on all goods and services a californian named ralph then goes into a course hero s 8 7 price per case 6 5 4 3 2 1 d 0 1 3 4 n 5 6 chegg 2 if a 10 sales tax is imposed on a good and the chegg s oon price per case 5 4 3 2 1 d 0 1 2 3 4 5 6 7 8 9 chegg homework chapter 8 homework flashcards quizlet 20 taxes pt 4 this is the 4th part on the market for chegg this is part of a series of questions on the market chegg solved suppose that california imposes a sales tax of 10 percent chegg B positive but less than 50000 per year.